Calculate price before tax

So if the room costs 169 before tax at a rate of 0055 your hotel tax will add 169 x 0055 9. It is a specific amount that is excluded from the gross total.

Percent Of Change With Tips Discount Markup And Sales Tax Task Cards Percent Of Change Middle School Math Resources School Motivation

Subtract the amount of tax you paid from the total post-tax price of the item.

. On or before 15th June. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Once you calculate your auto sales tax youll have a fuller understanding of the complete costs associated with your car purchase.

Calculate 10 of the rounded price. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. The tutorial is correct.

To calculate your mortgage payment using a mortgage calculator youll need to input details about your loan. Learn how to find out the local tax percentage and how to calculate its effect on your bill. On or before 15th March.

Now for the tougher example. Suppose Australia and New Zealand Banking Group Limited earn revenue of 14514 and its operating and non-operating expenses stand at 6508 and 3250 respectively. You cannot minus the 18 vattax directly to the gross amount.

With the true price tag in mind you can buy with. And now you can get the sales tax easily. The reason for that is the progressive nature of taxation.

The tax rate on every bracket is the statutory tax rate. Capital Gains Tax. Calculate net profit after tax for the company.

Now its time to plug the numbers into the selling price formula. See section 7 for the withholding rates. PAT Profit before tax Tax 282- 846 1974.

In some regions the tax is included in the price. 15 of advance tax. Council Tax is not included in the Consumer Prices Index CPI.

In the condition you can figure out the sales tax as follows. Since 19999 is only 1 cent away from 200 you would round up. Remember to convert the sales tax percentage to decimal format.

255 divided by 7250 is 0035 which means the tax rate is 35. Lenders calculate how much they will lend you to buy a home based on your monthly income minus any fixed recurring. Select the cell you will place the sales tax at enter the formula E4-E41E2 E4 is the tax-inclusive price and E2 is the tax rate into it and press the Enter key.

100 of advance tax less advance tax already paid. 115-97 lowered the backup withholding rate to 24 for tax years beginning after 2017 and before 2026. So if you paid 2675 in total for two books and you know from looking at the receipt that 175 of that was tax the books pre-tax cost was.

Since both your annual salary and gross income refer to the total amount of money you make before tax you dont need to do this calculation if you know your annual salary. Its always better to learn about them before a deal is final. The Income Tax Calculator offered by BankBazaar can be used to calculate the income tax on salary that must be paid.

To find out more information on the federal solar tax credit and calculate the credit amount per year based on household income. First you would take the total price and subtract the pre-tax item price from it. 115-97 lowered the withholding rates on supplemental wages for tax years beginning after 2017 and before 2026.

For more information on how to calculate sales tax including some examples scroll down. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004. Moving the decimal one place to the left you should see that 10 of 20000 is 2000.

The incremental tax rate 15 on 28625 and 25 on 42050 is basically the marginal tax rate. For instance if the list price is 7250 and you paid 7505 then you paid 255 in taxes. Income Tax Bank IFSC Codes Indian Holidays List Ratings Reviews EPF Cibil Experian India Equifax India Petrol Price Diesel Price Blog.

10000 gross sales 18 vat. Get 247 customer support help when you place a homework help service order with us. Educational and Non-Profit Institutions Documents.

Round the original price to the nearest ten. 3780 3500 3500 Then you would divide the whole thing by the pre-tax. On or before 15th December.

75 of advance tax less advance tax already paid. Estimate the sale price. The cost price for each bread machine is 150 and the business hopes to earn a 40 profit margin.

And Retail Prices Index RPI. On sale it is 45 off. If you dont know your annual salary use these steps to calculate your individual annual income before taxes.

The tax rate stands at 28. Use Bankrates auto loan calculator to find out your payment on any car loan. Those include home price down payment interest rate and your projected taxes and.

A tablet is regularly 19999. Number of units purchased. Selling Price 150 40 x 150 Selling Price 150 04 x 150.

Here is what the selling price formula would look like in action. For example below is a chart showing how a certain level of down payments based on a percentage of the sale price directly impacts your monthly mortgage payment based on a 30-year mortgage at a fixed rate of 4241 APR. On or before 15th September.

45 of advance tax less advance tax already paid. Commercial and utility-scale projects which have commenced construction before December 31 2023 may still qualify for the 26 or 22 percent ITC if they are placed in service before January 1 2026. This gives you the pre-tax price of the item.

This latest contribution is the largest since before the start of the National Statistics series in January 2006. An out-the-door price quote will reveal any hidden fees or extras in the contract including taxes title and registration. Advance Tax Payable.

OMB Circular A-21 Cost Principles for Educational Institutions 05102004 109 pages 263 kb Relocated to 2 CFR Part 220 30. So we can see that the effective tax rate is lower than the marginal tax rate but higher than the lowest bracket income tax. 18 is only added into net amount to get the gross price.

The review process for the items making up the inflation basket used to calculate the UK consumer price inflation indices and the. Lets say you paid 3780 total for an item that cost 3500.

Percents Sales Tax Tips And Commission Notes Task Cards And Worksheet

Product Pricing Calculator Handmade Item Pricing Worksheet Etsy Business Template Pricing Calculator Product Pricing Worksheet

Product Cost Price Profit Calculator Ebay Etsy Mercari Etsy Pricing Calculator Price Calculator Google Sheets

Money Math Solve Sales Tax Word Problems Worksheet Education Com Word Problem Worksheets Money Math Money Worksheets

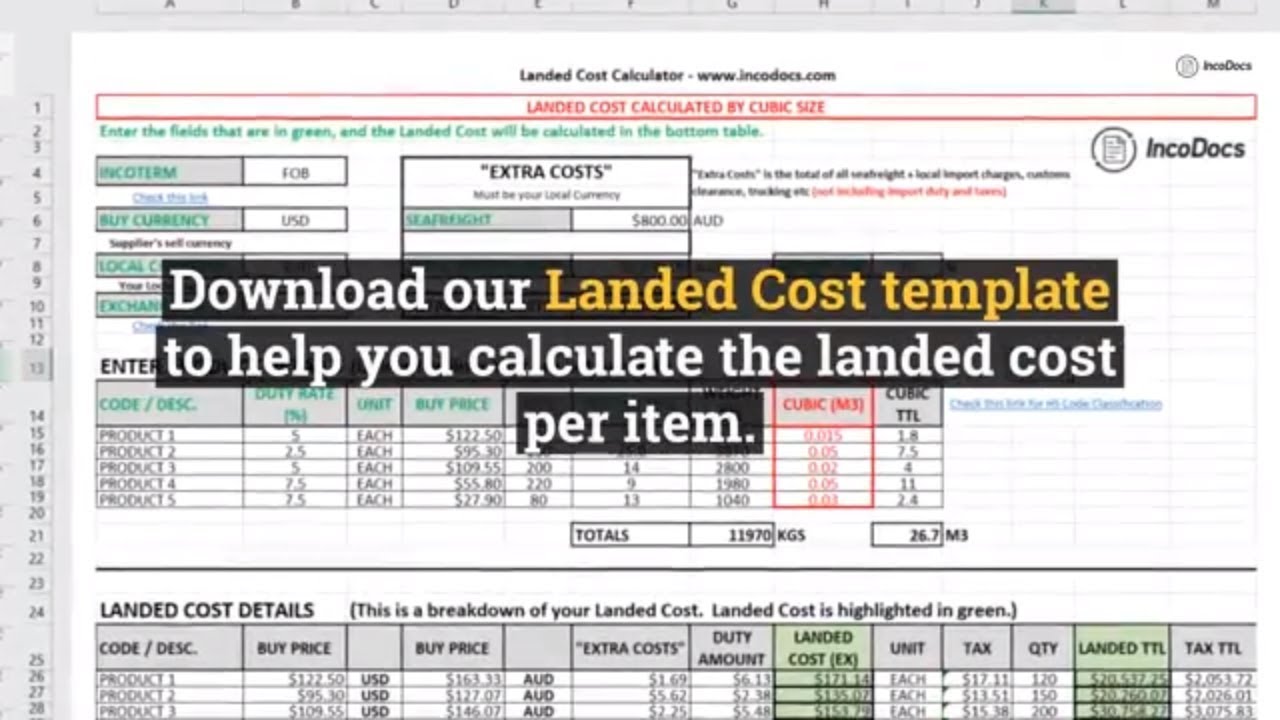

Calculate Landed Cost Excel Template For Import Export Inc Freight Customs Duty And Taxes Excel Templates Excel Verb Worksheets

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price Finance Career Financial Analysis Sales Tax

Product Cost Price Profit Calculator Ebay Etsy Mercari Etsy Excel Spreadsheets Price Calculator Spreadsheet Template

How To Estimate Tips Tax And Discounts Fifth Grade Math Tips Teaching

Etsy Pricing Profit And Fees Calculator For Digital Item Etsy Pricing Templates Craft Pricing Calculator Small Business Tools

Money Making Change Discounts Sales Tax Anchor Chart Jungle Academy Money Anchor Chart Teaching Mathematics Math Anchor Charts

Discount Price Digital Distance Learning Lesson Boom Cards Video Video Lesson Interactive Lessons Student Reflection

Sample Price Quotation Form Without Tax Calculation Ready Made Office Templates Be An Example Quotes Web Design Quotes Quotations

Fare Detail Package Airport Transfer 4 Hrs 40 Km Service Tax 5 8 Included Total Fare 794 Additional Pricing Details Pricing Km Will Be Calculate

Cost Of Goods Sold Spreadsheet Calculate Cogs For Handmade Sellers Cost Of Goods Sold Cost Of Goods Spreadsheet

Gst Calculator How To Find Out Goods And Service Tax Tax Refund

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Income Projection Calculator Use The Income Projection Calculator To Calculate Your Income Expense Profit And Loss Statement Spreadsheet Template Calculator